Download Free Vegan Starter Kit -

Alternative Protein Investments Broke Records In 2020, GFI Reports

19 March 2021

Even though the Covid-19 pandemic crippled markets in 2020, the alternative protein sector saw an increasing rise in funding.

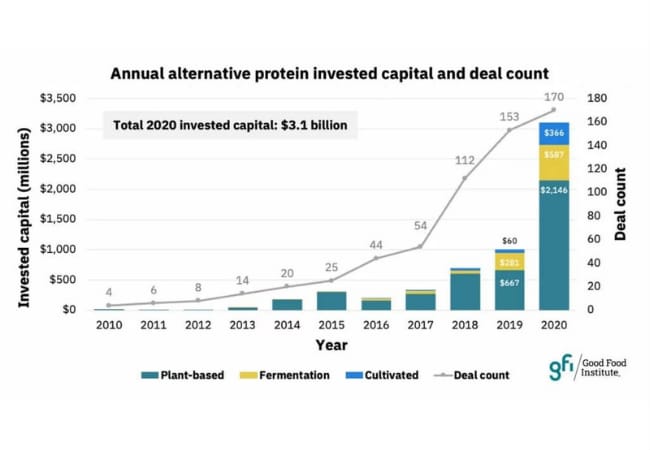

The Good Food Institute unveiled in a new report that 2020 was a "record period of investment" for alt protein companies across the world. Globally, the sector saw a net investment of $3.1 billion in 2020, which was thrice the amount of $1 billion from 2019. In 2018, the sector had raised $694 million.

Between 2010-2020, alternative protein companies over the world have raised approximately $6 billion, and the last year accounts for half of these investments.

Image Courtesy: GFI

Investments In Different Industries

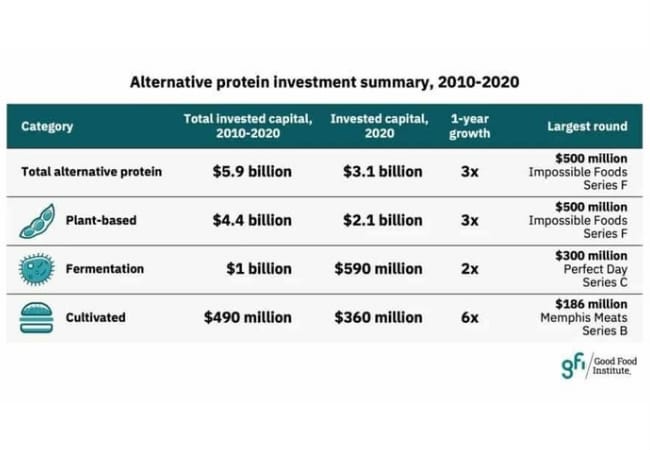

The plant-based meat, dairy and egg industry raised $2.1 billion in 2020, which was half of the $4.4 billion raised by this sector in the past decade. This is the single largest investment by this industry in one year, and three times the amount of 2019, which was $667 million. Out of these, Impossible Foods raised $700 million, Oatly raised $200 million with a $78 million debt financing.

The fermentation sector raised $590 million in 2020, followed by the cultured or cultivated meat sector which received $360 million. Fermentation companies have received $1 billion in investments since 2013, the largest funding round being Perfect Day's Series C funding of $300 million.

The cultured meat sector's investments in 2020 rose by six times since 2019, and accounts for 72 percent of the investment in this industry since its origin in 2016. The biggest rounds in the cultivated meat industry in 2020 were by Memphis Meats ($186 million) and Mosa Meat ($75 million).

Image Courtesy: GFI

Why Alternative Protein?

This boom in investments in the alternative protein sector is a clear sign of the rising demand for sustainable foods by consuners. Moreover, alternative proteins also do not cause public health risks, which was an important factor which determined investors' decisions during the global pandemic.

AUTHOR

trending

Be a Vegan First Informer

Send us buzzworthy news and updates

related

Nestle Plans To Build New Plant-based Food Facility in China Under CHF 100 Million Investment Plan

- Harsh Shah

- 6.8 K

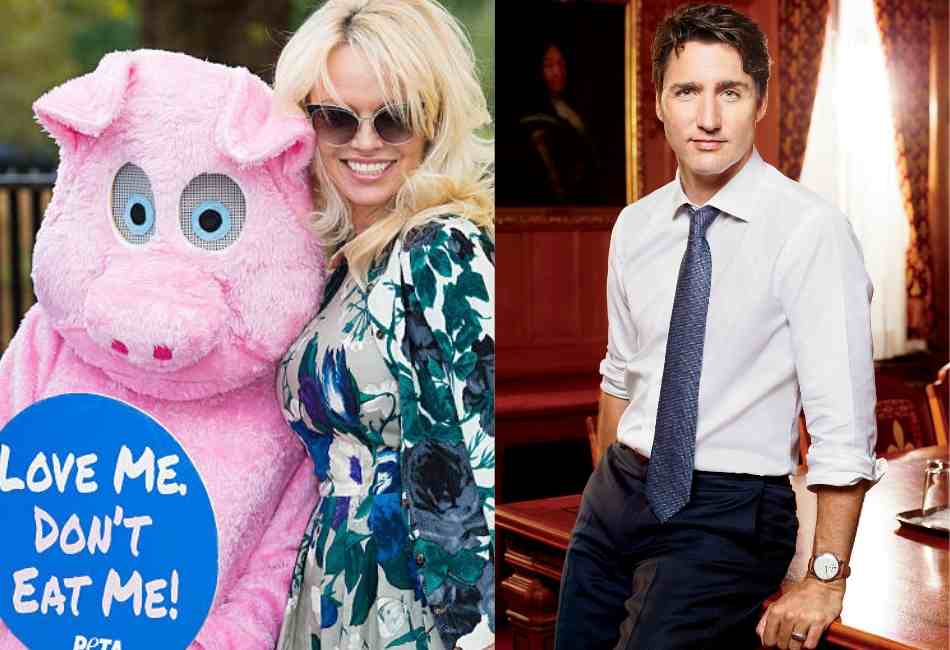

Canadian PM Justin Trudeau Announces $100 Million Investment in Plant-Based Industry

- Harsh Shah

- 6.5 K

Pamela Anderson to PM Justin Trudeau: "Nothing is Sexier than Compassion"; Offers to be Vegan Mentor

- Harsh Shah

- 2.7 K

Oprah Winfrey, Natalie Portman and Former Starbucks CEO Invest in Swedish Vegan Milk Company – Oatly

- Sufiya FZ

- 3.6 K

Explore

Contact Us

About Us

Stay Connected

Copyright ⓒ 2017-2023. VEGAN PASSION PRIVATE LIMITED. All Rights reserved.

For more information, please write to hello@veganfirst.com

Registered Office Address: 55, 2nd floor, lane 2, Westend Marg, Saidullajab, Near Saket Metro Station, New Delhi, Gadaipur, New Delhi South West Delhi, DL

2.png)

.png)

.png)

2.png)

2.png)

2.png)

1.png)